Are you ready for the RUP?

October signifies the start of Autumn. The leaves are falling off the trees, the nights are turning darker. For many E-Business Suite users, they are preparing the User Acceptance Testing (UAT) of the latest Roll Up Patch (RUP) for E-business 12.1 and 12.2 before the Christmas rush sets in.

A decline in new functionality for 12.1 users

The annual RUP for E-Business Suite 12.1 and 12.2 was released in May. Over the last few years its been possible to chart the decline in new functionality for 12.1 customers, while those on 12.2 seem to get all the nice new shiny things backported from HCM Cloud. With this decline in functionality, the end of Premier Support for 12.1 draws ever closer with December 2021 being confirmed for the end of Premier Support, with no extension on the horizon.

Once we wade past the legislative changes for 2019, that are applied in March/April, we can see the new features, with a larger chunk of new functionality aimed at 12.2 users (11 new features) and only three new features for 12.1 users.

What is a RUP?

The Human Capital Management (HCM) Roll Up Patch (RUP) forms part of Oracle’s continuous innovation program. There is a major release every year for EBS customers which contains new functionality and bug fixes. It makes sense to apply this release around the October-December sweet spot each year, allowing time for any bigger known issues to have raised their head before the tax year-end patch is released in January next year.

What is in this year’s RUP for all EBS customers?

As has been the recent trend, RUP for R12.1 offers little invention or new functionality. Desupport of the “All Balances Mode” in Generate Run Balances at Assignment Level has been introduced as a process improvement, but very little else of note.

Additional functionality for 12.2 customers

For RUP12.2, Version RUP13 receives new additions across the Payroll, Core HR, Advanced Benefits modules in addition to those in 12.1. A new Transfer to General Ledger Detail Report will make payroll/general ledger reconciliation(GLR) much easier, and in Self Service Human Resources (SSHR), it will be possible to update or delete approved and started absences.

Known Issues on Top of the RUP:

For those about to embark on this release, (12.1 RUP12 Note 2527240.1 & 12.2 RUP13 Note 2527218.1), it’s essential that one checks the known issues list regularly, particularly with HR, Payroll, SSHR, Time & Labour and Performance Management all receiving further updates at the time of writing.

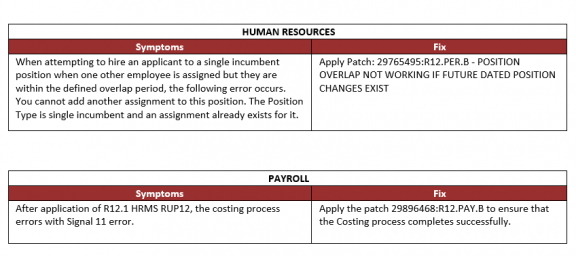

Currently, these are the following known issues affecting 12.1 RUP12 UK Legislation and are worth consideration:

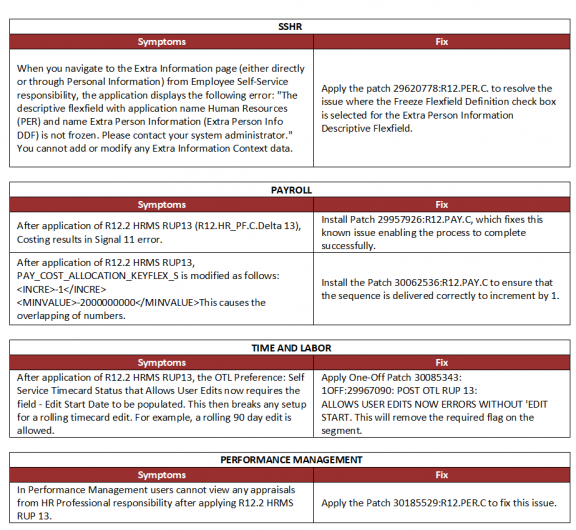

Currently, these are the following known issues affecting 12.2 RUP13 UK Legislation:

Choosing the right Managed Services Provider

If you are looking for an Oracle partner who can help you with your technology investment, goes about it the right way and can back up the talk, then contact us. If you would like to find out more about E-Business Suite updates or have an HCM question, you can email us at info@claremont.co.uk or phone us on +44 (0) 1483 549314.

Useful Links:

Oracle E-Business Suite Releases 12.1 and 12.2 Release Content 1302189.1

Oracle Human Resources Management Systems Readme, HRMS RUP12 for Release 12.1 2526650.1

Oracle Human Resources Management Systems Readme, HRMS RUP13 for Release 12.2 2495078.1

Known Issues on Top of Patch 28669292 – HRMS 12.1 RUP12 2527240.1

Known Issues on Top of Patch 28862999 – HRMS 12.2 RUP13 2527218.1

Announcements: E-Business Suite 12.1 Premier Support Now Through Dec. 2021 1495337.1